Florida has recently faced the impacts of two storms which struck just days apart. The barrier islands bore the brunt of the storms’ impact, leaving residents and business owners grappling with the insurance claims and decisions as to whether to replace or repair their properties.

At SVN Commercial Advisory Group, we are here for you at all times both good and challenging. We will assist you with buying, selling, or leasing commercial real estate, and we’re happy to discuss your current needs, including the feasibility of rebuilding or repairing properties affected by the hurricanes.

Jim Boyd, MAI, a Florida Certified General Real Estate Appraiser, has extensive experience conducting appraisals related to the FEMA 50% Rule in Sarasota, Manatee, Charlotte, and DeSoto counties. This rule states that if repair costs exceed 50% of a structure’s depreciated market value, it must be upgraded to comply with current floodplain management standards. Building departments may require this appraisal before issuing permits for repairs. Jim is happy to help with this process if necessary.

This article explores how storms in Florida have affected commercial property values since 2018 and provides some insight into their property values as a result.

The Impact of Recent Hurricanes on Commercial Real Estate

Using data from CoStar, a leading national commercial real estate service, we can examine the implications of Hurricanes Ian and Michael. While the market impacts of Helene and Milton are still emerging, it is important to analyze how previous storms affected property values.

Hurricane Ian, which struck in October 2018, was one of the most devastating storms on record, resulting in approximately $113 billion in damages. Its impact on the Lee County and Punta Gorda CoStar markets is particularly noteworthy. This was a devastating tropical cyclone which was the third costliest weather disaster on record worldwide, Ian caused catastrophic damage with losses estimated to be around $113 billion.

The retail and industrial sectors provide valuable insights into market trends.

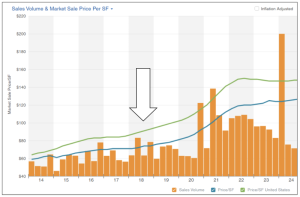

Lee County Costar Market- Retail

Source: CoStar.com 2024

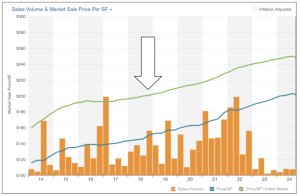

Lee County Costar Market-Industrial

Source: CoStar.com 2024

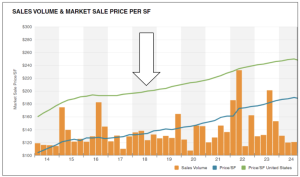

Punta Gorda CoStar Market-Retail

Source: CoStar.com 2024

Punta Gorda CoStar Market-Industrial

Source: CoStar.com 2024

Takeaway:

Looking at the charts, the blue line represents Lee County and Punta Gorda while the green line is the US as a whole. In Lee County, both pricing trends and sales volume appear relatively stable, while Punta Gorda saw a decrease in sales volume but maintained pricing levels. Notably, external factors like COVID-19, inflation, and rapid changes in Federal Funds rates have also influenced commercial mortgage terms and overall market dynamics.

Hurricane Michael, which also made landfall in October 2018, caused significant destruction, particularly in the Panama City Beach CoStar market. This Category 5 hurricane resulted in damages estimated at $25.1 billion, leading to loss of life and extensive property damage.

Panama City Beach CoStar Market-Retail

Source: CoStar.com 2024

Panama City Beach CoStar Market-Industrial

Source: CoStar.com 2024

Takeaway:

Similar to the previous analysis, the retail and industrial markets in Panama City Beach showed minimal impact in terms of pricing and sales volume despite the severity of the hurricane.

As we look to the future, it’s crucial for commercial property owners to understand these trends and consider the implications of recent hurricanes on their investments. If you’re contemplating repairs, rebuilding, or exploring new commercial real estate opportunities in Florida, the SVN Commercial Advisory Group is here to help.

Jim Boyd, MAI

Senior Advisor

FL Real Estate Broker #BK563808

FL State Certified General Real Estate Appraiser RZ1251