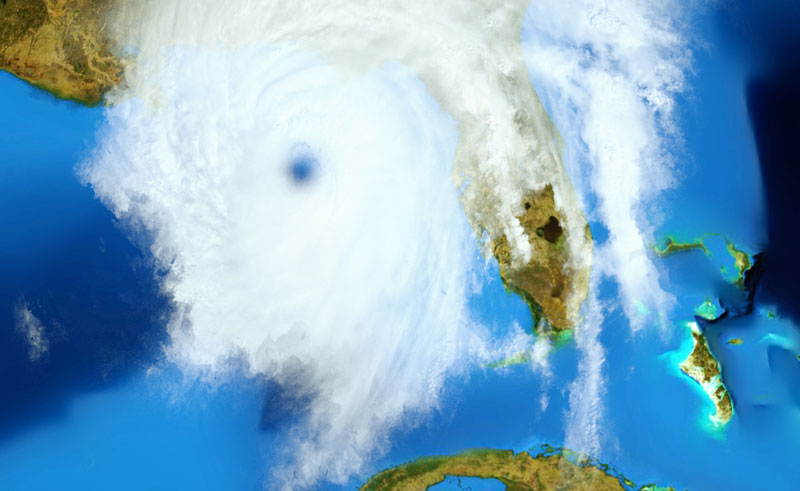

Florida, known for its sunny weather and strong real estate market, is also prone to natural disasters, particularly hurricanes. These powerful storms can devastate residential and commercial properties alike, causing billions of dollars in damages. Commercial real estate (CRE), in particular, faces unique challenges due to the nature of the buildings, the businesses they house and the economic ripple effects that follow.

The threat of hurricanes to CRE

Hurricanes bring a range of destructive forces, each of which can cause severe damage to CRE properties. Wind, for example, is a serious threat to commercial properties, which often consist of large structures: office buildings, shopping centers and industrial warehouses. Strong gusts can tear off roofs, break windows and cause structural damage to exterior walls.

Coastal commercial properties are especially vulnerable to flooding caused by storm surges. Hurricanes push massive amounts of seawater onto land, inundating commercial areas and inflicting considerable damage. Even properties miles from the coast can experience flooding.

Beyond physical damage, hurricanes often disrupt business operations. Power outages, damaged infrastructure and impassable roads can shut down businesses for days or weeks. This can lead to significant losses for tenants and landlords alike.

Economic impact

The economic implications of hurricane damage to commercial properties can be long-lasting. Insurance premiums for properties in hurricane-prone areas are often high, and some insurance companies may refuse to cover certain high-risk regions. The cost of repairs, combined with the potential loss of tenants or business partners, can push some property owners to the brink of financial instability.

The overall commercial real estate market may also experience depreciation in hurricane-prone areas. As buyers and investors become more cautious, property values may drop, affecting future sales and lease prices. The uncertainty surrounding the frequency and intensity of future storms also creates a volatile environment for developers and investors.

Damage assessment

The recovery process for commercial real estate after a hurricane is complex and involves several critical steps. The first is assessing the extent of the damage. Structural engineers, contractors and insurance adjusters evaluate the property to determine whether repairs are feasible and the extent to which rebuilding is necessary.

A thorough assessment ensures that no underlying issues are overlooked, such as weakened foundations or water damage that can lead to mold.

Insurance claims, financial assistance

For most commercial properties, insurance plays a key role in recovery. However, navigating insurance claims can be time-consuming and complicated. It’s essential for property owners to have detailed records of the damage, including photos, repair estimates and documentation of the business interruption. In some cases, federal disaster assistance or state grants may also be available to help with recovery costs.

Repairs and reconstruction

Repairs can begin once damage is assessed and insurance claims are in progress. Depending on the severity of the damage, this process can take anywhere from a few weeks to several months. During this time, businesses housed in the property may need to relocate temporarily, adding another layer of complexity.

Boosting resilience and rebuilding

During the rebuilding process, many property owners take the opportunity to invest in improvements that make their buildings more resilient to future storms. This may include installing impact-resistant windows, upgrading roofs or elevating buildings to reduce flood risk. While these improvements come with additional costs, they can mitigate future damages and lower insurance premiums.

In the aftermath of a hurricane, communication with tenants is key. Property owners need to keep businesses informed about repair timelines and any alternative options that are available. Offering rent relief or finding temporary spaces for tenants can foster stronger landlord-tenant relationships and help ensure that businesses return once the property is restored.

Long-term preparedness

While immediate recovery is crucial, long-term strategies for disaster preparedness can help ease the impact of future hurricanes. Florida’s CRE industry has increasingly embraced technologies and construction methods designed to improve resilience. For example, modern building codes require properties to withstand certain wind speeds and storm conditions. Property owners can also invest in flood barriers, backup power systems and other infrastructure designed to reduce the impact of storms.

In addition, more businesses are adopting continuity plans that address how to manage operations in the event of a disaster. These plans may include securing alternative locations, using cloud-based technologies for data storage and coordinating with property owners on recovery efforts.

Strengthening against the future

Hurricanes pose a significant, ongoing threat to CRE in Florida. However, through preparation, insurance coverage and strategic recovery efforts, property owners can rebuild and even strengthen buildings against future storms. By focusing on resilience and preparedness, Florida’s CRE industry can better withstand these storms and their aftermath.