Despite a recent slowdown, Sarasota’s industrial market remains in an expansion phase, following several years of strong construction activity. Over the past three years, more than 4.3 million square feet of new space—about 5% of the metro’s total inventory—has been added, with 1.4 million SF completed in the last year and another 400,000 SF under construction.

While vacancy has risen to 7.8% amid this wave of new supply and some large tenant relocations, such as United Natural Foods’ move to its new 1.1-million-SF facility, these changes reflect ongoing modernization and long-term growth in the region’s logistics and distribution capacity.

Asking rents continue to rise steadily—up 3.2% year-over-year to $13.40/SF—remaining consistent with other Southwest Florida markets. Although rent growth has moderated from last year’s record pace, Sarasota’s fundamentals remain solid, supported by continued investment and development momentum across the industrial sector.

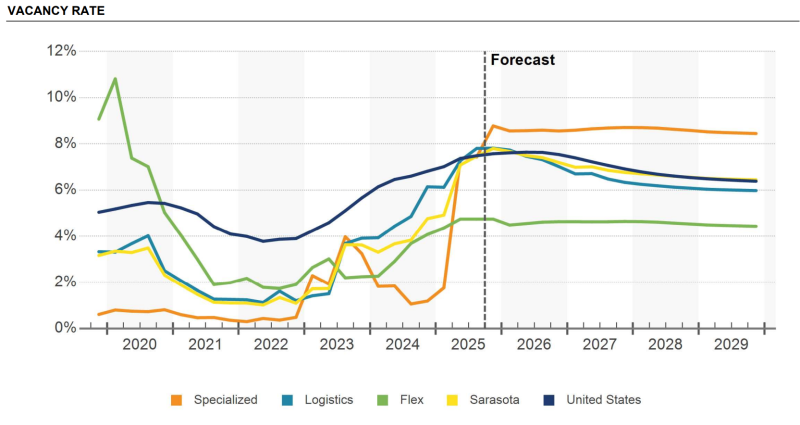

VACANCY RATE

The market’s vacancy rate has climbed considerably, now sitting at 7.8% as of the fourth quarter of 2025. Over the trailing 12-month period, this represents an increase of more than 350 basis points (3.5%). Concurrently, the 12-month net absorption has turned negative at (877,000) SF. This negative trend is a significant reversal from the positive absorption recorded the year prior, with a major contributing factor being United National Foods vacating its large 760,000 SF facility.

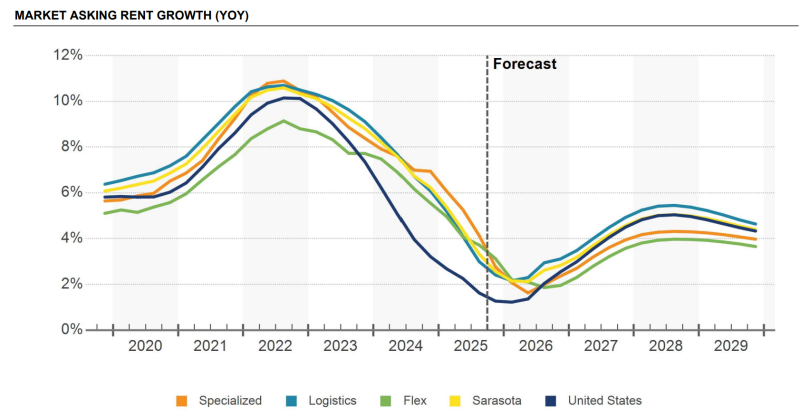

RENT GROWTH

Construction activity has added substantial inventory to the market, with roughly 1.4 million SF delivered over the trailing 12-month period. This volume of new space, much of which was completed with little preleasing, has contributed to the softening market conditions. As a result, asking rent growth has cooled to an increase of 3.2% over the past year, bringing the average asking rent to $13.40/SF as of Q4 2025. This current growth rate is roughly half the pace recorded this time last year.

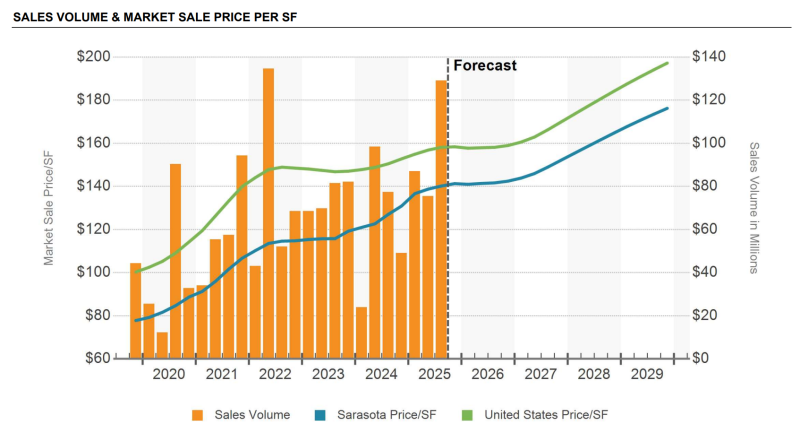

INVESTMENT SALES MARKET

Despite the moderating leasing and development metrics, the investment sales market remains robust. Overall, $340 million in sales volume has been recorded in the Sarasota industrial market over the past year, which is well above the pre-pandemic annual average of roughly $100 million. The market is not overly reliant on institutional capital, with the bulk of trades being smaller in size, reflected by an average sale price of just $2 million.

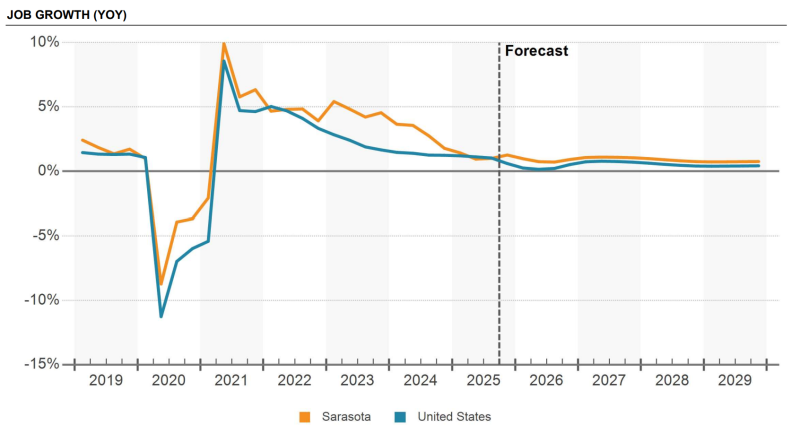

ECONOMY

The broader Sarasota region, encompassing Sarasota and Manatee Counties, remains the largest market in Southwest Florida and continues to attract new residents and businesses. While the pace of growth has slowed from the pandemic-era surge, the region’s population has increased by 13.0% over the past five years, substantially outpacing the national growth rate of 3.2%. Industrial-using employment, however, has softened, rising only 0.6% year-over-year.