As Sarasota County continues to grow and evolve, the July 2025 Economic Report paints a dynamic picture of key indicators shaping the region’s future. Here’s a concise breakdown of where we stand—and what it means for investors, developers, and businesses.

🔨 Building & Housing Activity

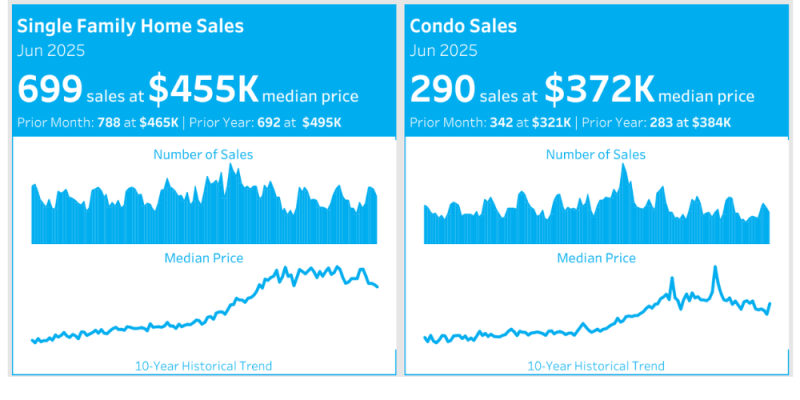

In June 2025, 156 single-family home building permits were issued—up from 114 in May but down from 174 last year. The median sales price for single-family homes was $455K across 699 sales, while condos saw 290 sales with a median price of $372K. Both sectors show a slight dip from prior months and 2024 levels, reflecting subtle market shifts.

📉 Employment & Workforce

The local unemployment rate rose to 4.3% in June, up from 3.7% in May and 3.6% in June 2024. While still manageable, it may indicate softening in hiring. Leading industries remain strong, with health care and social assistance (37,286 jobs) and retail trade (35,979 jobs) leading the pack.

Top employers include Sarasota Memorial Hospital (10,597 employees), the School Board of Sarasota County, and Publix Super Markets.

✈ Tourism & Transportation

Tourism cooled slightly with hotel & motel gross sales dropping to $77M, down from $97M in May. SRQ Airport passengers also declined to 333,854, a slight dip from last month’s 367,246. These seasonal adjustments reflect common summer trends but are worth monitoring for hospitality-focused investors.

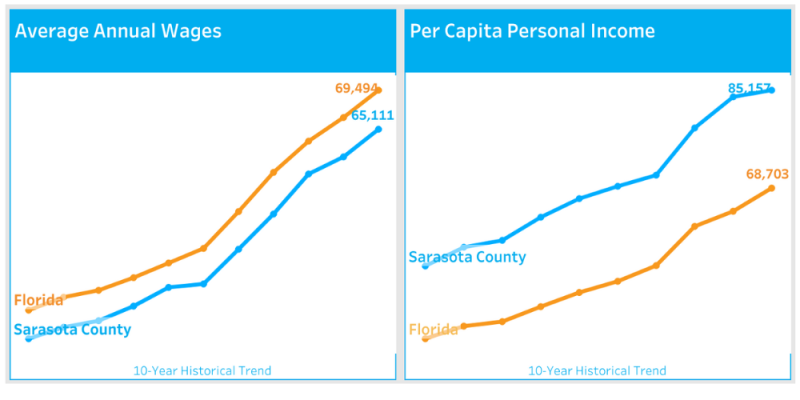

💵 Wages & Income

Sarasota County’s average annual wage sits at $65,111, compared to Florida’s average of $69,494. However, the per capita personal income for the county is $85,157, far exceeding the state average of $68,703—a positive signal for local purchasing power and standard of living.

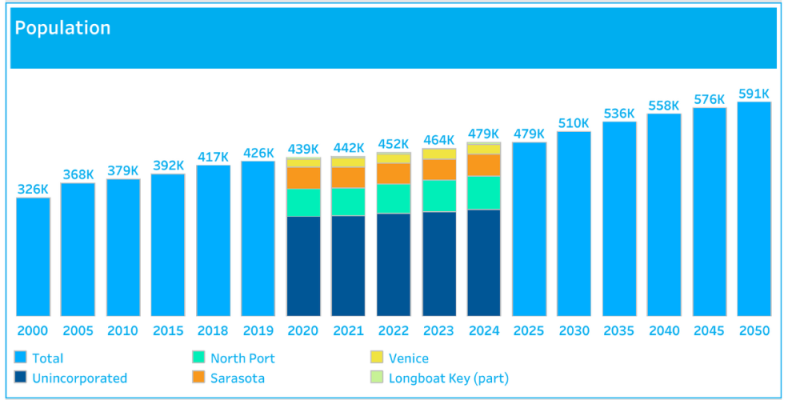

📈 Tax Base & Population Growth

Taxable values climbed to $103.9B in 2025, continuing a strong upward trend from $94.2B in 2024. Meanwhile, population projections show robust growth, with the county expected to reach 510K by 2030 and 591K by 2050—up from 479K in 2024.

Takeaway for CRE investors

Sarasota County continues to demonstrate resilience, economic diversity, and long-term growth potential. For commercial real estate investors, these trends suggest continued opportunity across housing, healthcare, retail, and infrastructure sectors.

Want more insights on how to position your portfolio in Sarasota’s evolving market? Contact our team for localized advisory support.

Source: Sarasota County Government