The Southwest Florida commercial real estate market continues to set records as both local and out-of-state businesses and investors continue to see long term value in the sunshine state. Many new, major developments underway in Sarasota, Bradenton, St. Pete and Tampa. Domestic and international investors are contributing to the market, and overall analysts continue their bullish outlook with positive predictions for the future.

The Southwest Florida commercial real estate market continues to set records as both local and out-of-state businesses and investors continue to see long term value in the sunshine state. Many new, major developments underway in Sarasota, Bradenton, St. Pete and Tampa. Domestic and international investors are contributing to the market, and overall analysts continue their bullish outlook with positive predictions for the future.

Locally real estate investors continue to take interest in medical office buildings, multifamily, hospitality, and retail due to a fast-growing population of seniors and an influx of new residents. The local market has recently been called one of “the Best US Cities for Medical Office Investors” due to the demographic changes combined with the least amount of competition for tenants and little medical office construction.

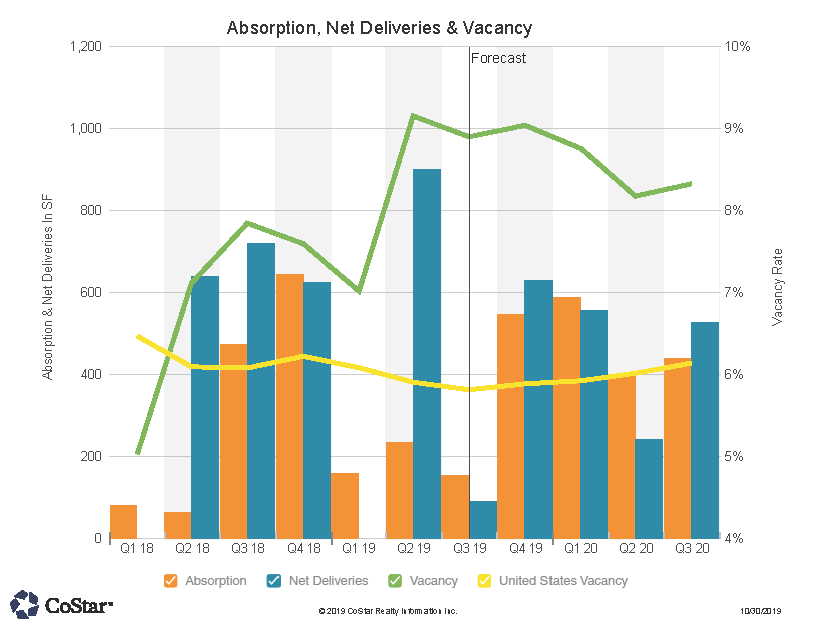

Multifamily construction and development continues to produce a constant stream of supply in the area. Once the 2,500 units under construction deliver, inventory will have increased by roughly 35% in the past five years. This has created a downward pressure on annual rent growth, though it still somewhat elevated compared to historical trends.

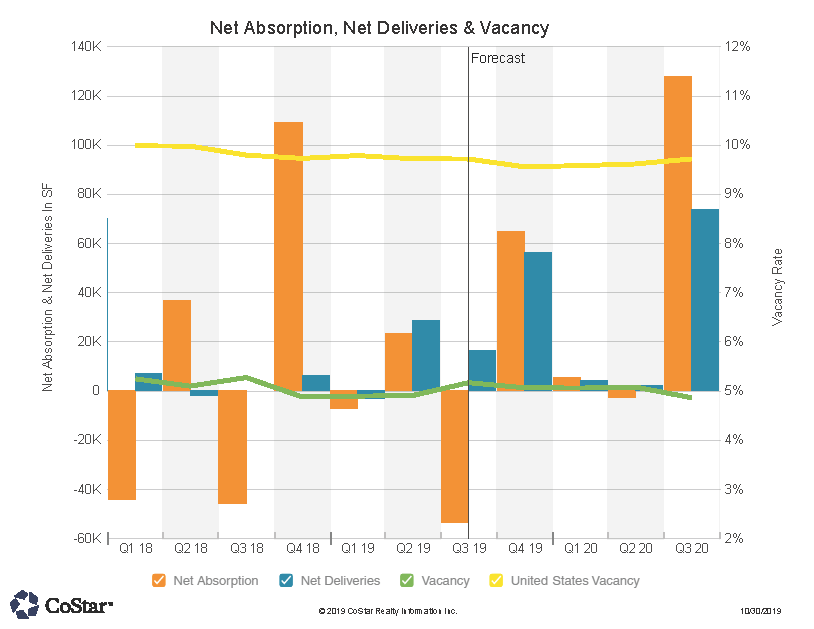

The lack of new supply and strong demand has led to positive net absorption over the past four quarters and vacancies in 2019 have compressed to nearly half of the long term trend. Office-using employment being among the largest growth sectors in the area, has continued to fuel strong demand for office, with 60% of the inventory located in the Sarasota submarket.

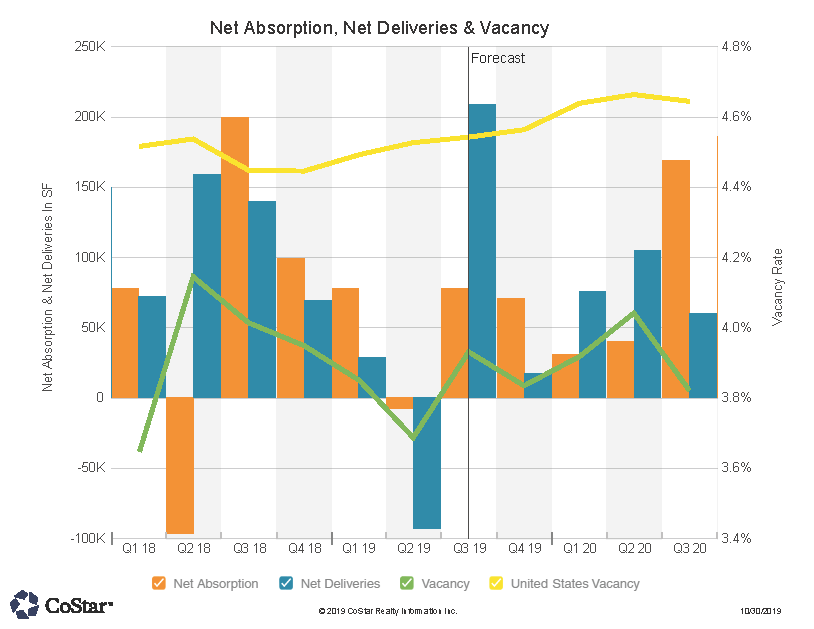

Sarasota’s retail market is perhaps as healthy as at any period in its history. Thanks in large part to a flourishing tourist industry and one of the nation’s highest population growth rates, Sarasota continues to benefit from consistently strong retail demand. This has combined with muted new construction to gradually compress vacancies to a level well below the long-term average. Despite the healthy market fundamentals, annual rent growth has sharply fallen off in 2019. Nearly all sectors have seen slowing rent growth this year.

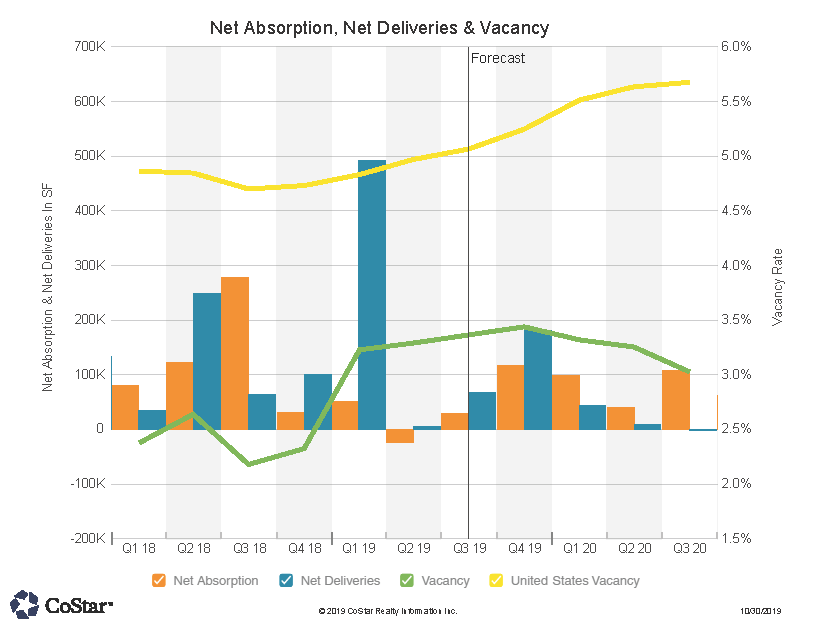

Sarasota’s industrial market has seen mild slippage in vacancies in 2019, largely the product of a mild increase in supply. Despite the relative cooling, the market remains healthy with a vacancy rate only about 100 basis points above the all-time low. The metro is effectively in equilibrium and unlikely to see significant net positive absorption without a continued rise in speculative construction.