Ultra-Low Vacancy and Steady Growth Make the Sarasota-Bradenton Retail Market an Opportunity Hotspot

Sarasota Retail Market Snapshot: Key Metrics Q1 2026

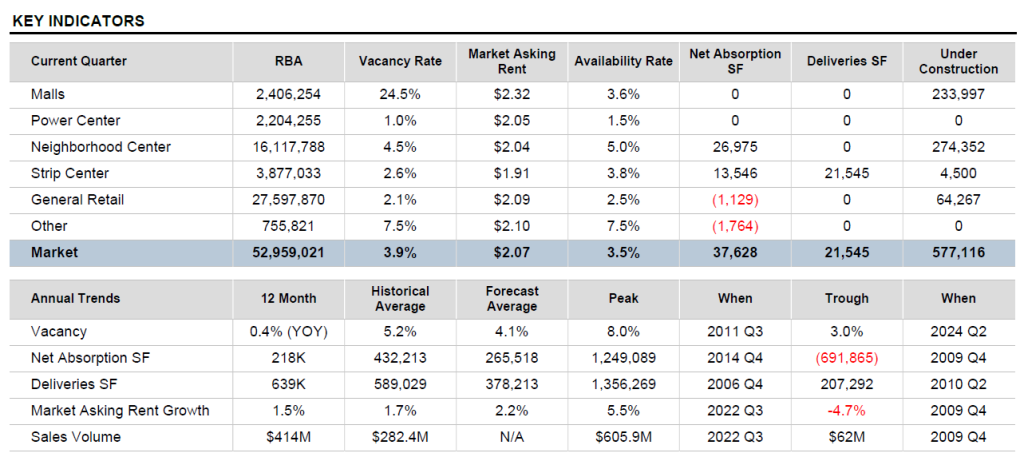

The Sarasota retail market continues to demonstrate exceptional strength, with market fundamentals reflecting sustained demand across Florida’s Gulf Coast:

- Vacancy Rate: 3.9% – in line with five-year average

- 12-Month Net Absorption: 218,000 SF – strong tenant demand

- 12-Month Deliveries: 639,000 SF – active development pipeline

- Rent Growth: 1.5% year-over-year

- Market Rent: $25.00/SF average

Sarasota Retail Commercial Real Estate Key Indicators 2026 Q1 | Source: CoStar Sarasota Retail Market Report (1/8/26)

Spanning Manatee and Sarasota counties along Florida’s Gulf Coast, this submarket remains one of the most resilient retail environments in the state.

Geographic Advantage: Prime Gulf Coast Location

Anchored by four thriving municipalities—Bradenton, Sarasota, Venice, and North Port—strategic positioning along I-75 and U.S. 41 corridors provides seamless connectivity to Tampa and Fort Myers, while Sarasota-Bradenton International Airport delivers critical air access for residents, industry, and the tourism sector.

Retail development in the region favors auto-oriented corridors such as Tamiami Trail and Cortez Road, where neighborhood shopping centers and freestanding retail pads dominate. Proximity to coastal amenities, master-planned residential communities—such as Lakewood Ranch—and employment centers continues to support long-term retail demand and the area is still growing.

Market Composition: Diverse Retail Inventory

With 53 million square feet of total retail inventory, the Sarasota market offers diverse property types:

- Neighborhood Centers: 16.1M SF (4.5% vacancy)

- General Retail: 27.6M SF (2.1% vacancy)

- Strip Centers: 3.9M SF (2.6% vacancy)

- Power Centers: 2.2M SF (1.0% vacancy)

- Mall Properties: 2.4M SF (24.5% vacancy)

As of Q1 2026, roughly 580,000 SF of retail space is under construction, modestly above the market’s 10-year average of 510,000 SF. Over the past 12 months, the market delivered approximately 639,000 SF, while recording 218,000 SF of net absorption, signaling continued tenant demand despite new supply.

Development Pipeline: Strategic Growth

Current retail space under construction totals 580,000 SF, slightly above the 10-year average of 510,000 SF. This measured development approach maintains market equilibrium while accommodating growth from both population expansion and business relocation trends.

Approximately 1.9 million SF of retail space is currently listed as available, representing a 3.5% availability rate—a clear indicator of supply-constrained conditions in most retail categories, supporting favorable landlord pricing power in negotiations.

Rent Performance: Sustained Appreciation

Market asking rents in Sarasota average $25.00 per square foot, reflecting 1.5% year-over-year growth, slightly below the national average of 1.9% but consistent with the market’s long-term stability.

Annual rent growth by property type includes:

- Neighborhood Centers: +1.8%

- Power Centers: +1.8%

- Strip Centers: +1.6%

- Malls: +2.0%

- General Retail: +1.2%

Over the long term, Sarasota continues to outperform many peer markets, with five-year average annual rent growth of 4.1% and 10-year average annual growth of 3.4%.

Current market conditions favor landlords, with below-average vacancy constraining supply while demand from both national and regional tenants remains robust.

Market Outlook: Opportunity in Scarcity

The Sarasota retail market’s 3.9% vacancy rate – matching the five-year average and below the 10-year average of 4.2% – signals sustained market health. Limited availability, steady absorption, and disciplined development activity continue to support balanced market conditions across most retail property types, excluding enclosed malls.

Explore all of our available retail investment and leasing opportunities here.

For tailored insights, site selection, leasing, or investment opportunities in the Sarasota and Manatee County retail markets, SVN Commercial Advisory Group, Sarasota’s leading retail commercial real estate brokerage, provides local expertise backed by national reach.

Contact us for a consultation or reach out to one of our expert retail Advisors.

SVN Commercial Advisory Group offers investors, developers, owners, and tenants expert guidance on Sarasota, Central, and Southwest Florida retail opportunities. Our local market expertise and regional platform deliver results for investors, landlords, and tenants navigating Central and Southwest Florida’s most dynamic retail markets.

📍 Serving Sarasota, Bradenton, Venice, North Port, Orlando & Southwest Florida