Manatee County’s broader growth backdrop remains constructive: strong in-migration and new-home activity anchored by east-county communities like Lakewood Ranch, steady—if moderating—job gains across the North Port–Bradenton–Sarasota economy, and ongoing infrastructure improvements at SeaPort Manatee that enhance regional logistics.

At the same time, shifts in the local economic-development landscape (including changes to EDC funding) bear watching for their potential impact on business attraction and permitting. Taken together, these dynamics help explain why demand in select office subtypes (notably medical, professional services, and port-adjacent users) remains supported even as the market digests recent absorption trends—setting the context for the Q3 2025 Manatee office metrics that follow.

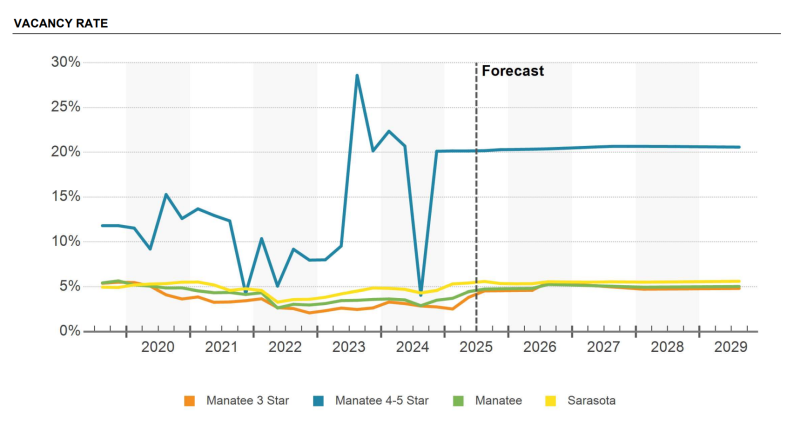

With vacancy at 4.7% in Q3 2025 and no new office construction underway, Manatee’s office market is defined by tight new supply alongside a year of softer demand—-150,000 SF of net absorption—that nudged vacancy up 1.8% year over year.

Availability totals ~490,000 SF (5.9%) across 8.3 million SF of submarket inventory (27.5 million SF metro), placing current vacancy slightly above the 5-year (3.8%) and below the 10-year (4.6%) benchmarks.

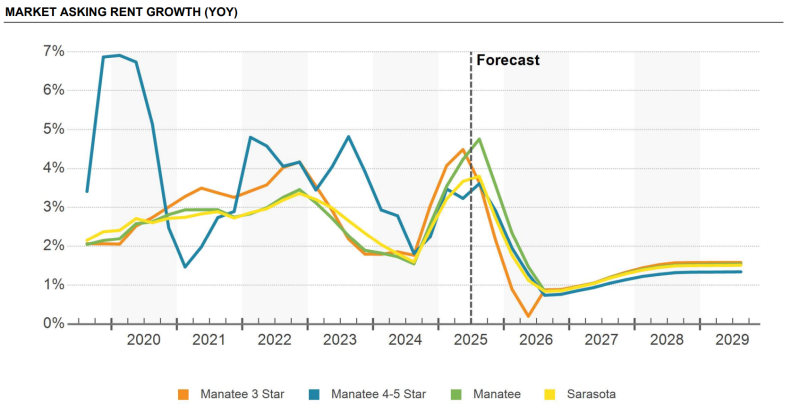

Pricing remains firm: average asking rent is about $27/SF (vs. $28/SF metro) with 4.7% annual rent growth, outpacing the metro’s 3.8% and exceeding Manatee’s 5-year (2.8%) and 10-year (2.4%) trends.

Vacancy & Availability

- Vacancy: 4.7% in Q3 2025; +1.8% YoY linked to ~150,000 SF negative net absorption and no net new deliveries.

- Available space: ~490,000 SF; availability rate 5.9%.

- Today’s vacancy vs history: 5-yr avg 3.8%, 10-yr avg 4.6%.

Rents & Growth

- Asking rent: ~$27.00/SF (Manatee) vs ~$28.00/SF (metro).

- Rent growth: +4.7% YoY in Manatee vs +3.8% metro; Manatee’s 5-yr avg 2.8%, 10-yr avg 2.4%.

Supply & Pipeline

- No office space under construction in Q3 2025; ~11,000 SF average under construction over the past decade.

Scale & Share

- Inventory: ~8.3 million SF in Manatee vs ~27.5 million SF metro-wide.

With no active construction, sub-5% vacancy, and rent growth outpacing both the metro and Manatee’s long-term averages, fundamentals remain supported by constrained new supply and steady pricing power—even as last year’s negative absorption lifted vacancy.

For more information on the Manatee County office market, contact us for a confidential consultation.