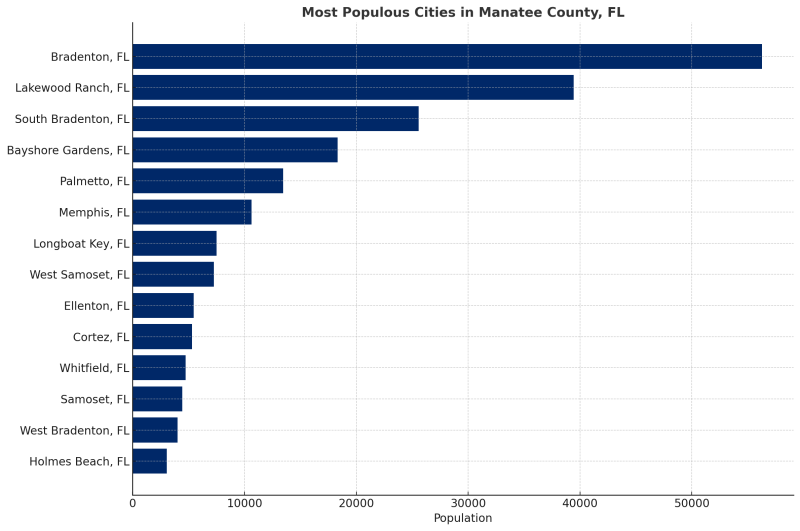

Manatee County is in the midst of a population boom. Between April 2020 and July 2024, the county experienced a remarkable 14.7% surge in population, adding nearly 60,000 new residents in just four years. This rapid growth is reshaping the region’s commercial landscape, driving demand for retail space while also creating challenges for absorption for certain retail properties, while others are faring well.

Data Source: Data Commons

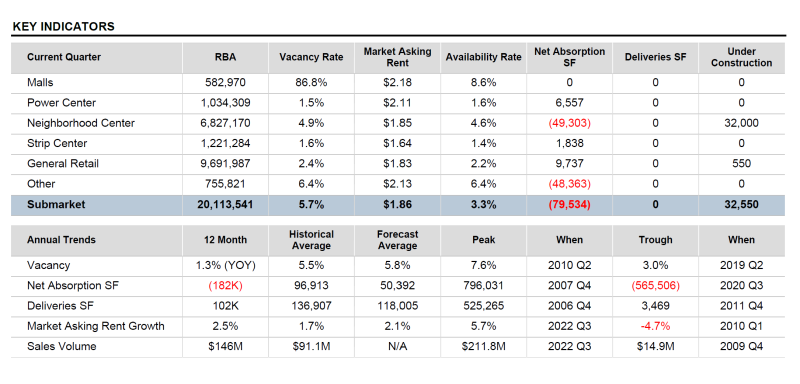

As of Q2 2025, Manatee County had a vacancy rate of 5.7%, slightly above its five-year average of 5.2% and 10-year average of 4.8%. This increase reflects net negative absorption of 180,000 SF over the past 12 months and 85,000 square feet of net delivered space.

Among retail property types:

- Neighborhood centers show a 4.9% vacancy rate

- Power centers: 1.5%

- Strip centers: 1.6%

- General retail: 2.4%

- Malls: a significantly higher 86.8%

Source: CoStar Manatee Submarket Retail Report | June 20, 2025

Total available space across the submarket stands at approximately 660,000 SF, or an availability rate of 3.3%.

Retail construction activity is limited, with just 33,000 SF underway, well below the 10-year average of 110,000 SF. The total retail inventory in Manatee includes 20.1 million SF, led by general retail (9.7M SF), neighborhood centers (6.8M SF), and smaller segments of strip, power, and mall centers.

Market rents average $22.00/SF, with a year-over-year growth of 2.5%, consistent with the Sarasota metro area. Rent increases were strongest in neighborhood and strip centers (2.8% each), while malls trailed at 2.1%. This growth rate is below the submarket’s five-year average (4.3%) and 10-year average (3.5%).

Data Source: CoStar Retail Submarket Report | Manatee, Sarasota, FL | June 20, 2025