The Impact of Fed Fund Rate Increase on Cap Rates and Property Values

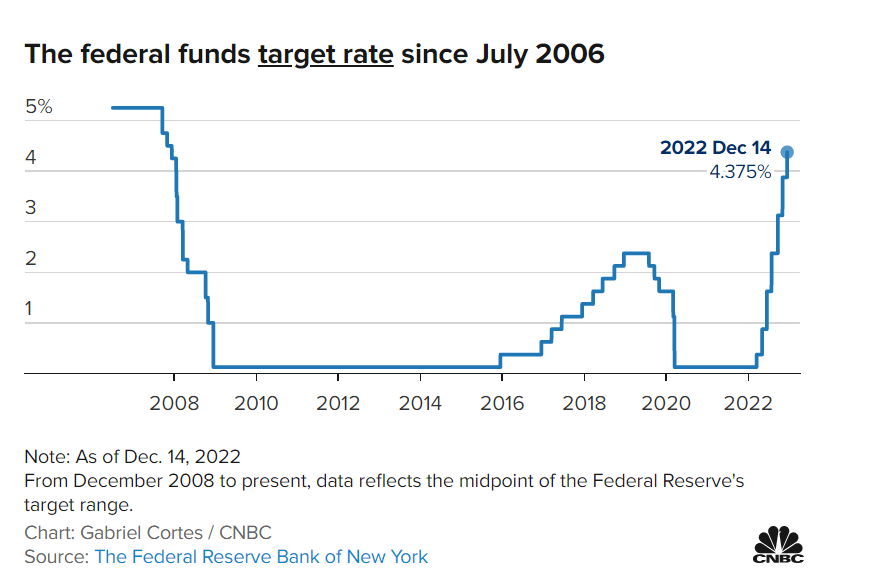

The Federal Reserve raised its benchmark interest rate to its highest level in 15 years on December 14, 2022, leading to an increase in commercial lending rates. This raises the question of how this is affecting cap rates and property values in the commercial real estate market.

Cap Rates and Property Values by Sector

To understand the current impact on cap rates and property values, let’s examine data from CoStar, a leading provider of commercial real estate information. The following is a summary of the findings for the industrial, multi-family, and retail sectors:

- Industrial sector: According to CoStar data, there has been little to no change in cap rates in the industrial sector as a result of the increase in mortgage rates.

- Multiple family sector: CoStar’s data shows similar results in the multiple family sector, with little to no change in cap rates.

- Retail sector: The retail sector also shows little to no change in cap rates, according to CoStar’s data.

Factors Contributing to the Trend

Despite the increase in mortgage rates, cap rates and property values have remained unchanged. This trend can be attributed to several factors, including:

- High Florida in-migration rate: With an estimated 55% net inflow of movers to Florida, the state is seeing significant growth and creating demand for housing, services, and goods.

- High out-migration rates in other states: States like Illinois, California, and New Jersey have high out-migration rates, contributing to Florida’s growth as the fastest-growing state according to the Census Bureau in 2022.

- High demand for dwelling units: With over 422,000 new residents in Florida, the Census Bureau estimates a demand for over 135,000 additional dwelling units per year, based on an average household size of 3.13 persons.

- Short-term commercial mortgage rates: Unlike residential mortgage rates, commercial mortgage rates tend to be short term, which limits their impact on cap rates and property values.

In conclusion, the recent increase in the Fed Fund rate has had little impact on cap rates and property values in the commercial real estate market. Despite the increase in mortgage rates, the strong demand for housing and services in growing states like Florida, as well as the nature of commercial mortgage rates, has helped to maintain stability in the market.

By Jim Boyd, MAI

Senior Advisor | SVN Commercial Advisory Group